In What Ways Can An Insurance Agent Assist You Minimize Your Expenses?

Web Content Writer-Gates Siegel Have you ever before questioned exactly how an insurance policy agent could help you conserve cash? Well, visit link is, their knowledge surpasses simply locating you a plan. By diving into the intricacies of insurance policy protection and tapping into different discount rates, representatives have the power to dramatically impact your bottom line. Yet that's just the tip of the iceberg. Keep tuned for more information about the specific methods an insurance policy representative can put even more cash back in your pocket.

Perks of Using a Representative

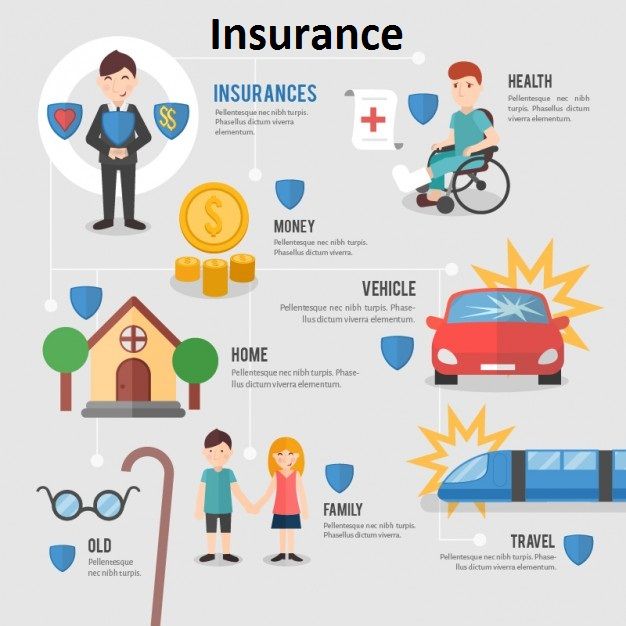

When it comes to browsing the complicated globe of insurance, using the proficiency of an insurance coverage representative can be incredibly beneficial. An agent can assist you recognize the details of different insurance plan, guaranteeing you choose the appropriate insurance coverage for your specific needs. As opposed to costs hours looking into and comparing policies by yourself, an agent can streamline the procedure by supplying customized suggestions based upon your specific situations. In addition, insurance agents often have accessibility to a wide variety of insurance coverage service providers, permitting them to help you discover the most effective insurance coverage at competitive prices. They can bargain on your behalf and potentially protected discount rates that you might not have actually had the ability to gain access to on your own. In addition, in case of a case, representatives can lead you via the process, addressing any concerns and advocating for your best interests.

Optimizing Plan Discount Rates

To ensure you're obtaining one of the most out of your insurance plan, taking full advantage of available discount rates is vital. Insurance coverage agents can aid you identify and profit from numerous price cuts that you may get. For instance, bundling your home and car insurance policy with the very same supplier often causes a significant discount. In addition, having an excellent driving record, setting up security functions in your home or car, or perhaps being a member of specific companies can make you eligible for further discount rates. See to it to educate your insurance policy representative concerning any life changes or updates in your conditions, as these may open up new discount rate chances.

Staying Clear Of Costly Insurance Coverage Mistakes

Stay clear of falling under pricey coverage blunders by thoroughly comprehending your insurance policy details. One common error is taking too lightly the value of your possessions when establishing protection limits. Make certain that your plan accurately shows the substitute expense of your valuables to stay clear of being underinsured in case of a case. In addition, falling short to upgrade your plan frequently can result in spaces in coverage. Highly recommended Website as purchasing a brand-new car or remodeling your home may need modifications to your insurance to properly secure your possessions. Another costly blunder is ignoring additional protection options that can provide useful defense. For example, umbrella insurance coverage can use expanded responsibility protection beyond your standard policy restrictions, guarding your properties in risky scenarios. Finally, not understanding your plan exclusions can lead to unexpected out-of-pocket expenditures. Put in the time to evaluate and clear up any exclusions with your insurance representative to stay clear of being captured off guard by exposed losses. By being proactive and educated, you can avoid pricey coverage errors and ensure your insurance fulfills your demands. Conclusion To conclude, collaborating with an insurance policy representative can be a wise monetary relocation. They can assist you comprehend plans, maximize discounts, and stay clear of costly errors, inevitably saving you cash. By leveraging their knowledge and sector expertise, you can secure the most effective coverage at competitive rates. So, take into consideration talking to an agent to ensure you are getting one of the most worth out of your insurance policies.